Welcome to The Ultimate Car Buyer's Guide, your comprehensive guide to making informed decisions and driving away with the perfect vehicle for you. We'll break down every step of the car buying journey, from initial budgeting to understanding the crucial details of financing and even navigating the latest tax changes. Consider this your trusted roadmap to automotive satisfaction.

Budgeting & Needs Assessment

Before browsing for a new vehicle, the most critical step is to understand your financial boundaries and identify your vehicle needs.

Beyond the Sticker Price: When shopping for a vehicle don't just focus on the price advertised. You must consider the total cost of ownership which includes sales tax, registration fees, insurance costs, and future maintenance expenses. Once you've accounted for all these potential costs, make sure the price point is at a comfortable monthly payment that fits within your overall budget. Remember to account for potential increases in insurance premiums and fuel costs.

Define Your Vehicle Needs: It's easy to get caught up in the excitement of wanting the newest vehicle with all the latest features, but that desire can often lead to overall costs that simply don't align with your budget. When browsing for a new vehicle take into consideration passenger capacity, cargo space, driving conditions, and fuel efficiency. To make a truly informed decision that serves you well in the long run, create a clear list distinguishing between essential features you absolutely need and desired features that would be nice to have, helping you prioritize functionality and affordability.

The Key to Lower Rates

Securing the most favorable financing for your next vehicle hinges significantly on your credit score. A strong credit history, typically reflected by a good to excellent credit score, is the key to unlocking the lowest interest rates available, potentially saving you hundreds or even thousands of dollars over the lifetime of your auto loan.

What is a Credit Score? Your credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. It's a key factor lenders use to assess the risk of lending you money. A higher score indicates a lower risk, generally leading to more favorable loan terms.

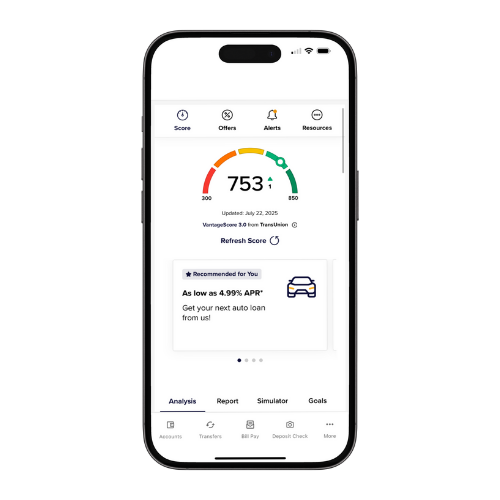

Checking Your Credit: Obtain a copy of your credit report from Annual Credit Report, you can only get one free report per year. Diligently review this report for any errors or inaccuracies and dispute them immediately, as even small discrepancies can negatively impact your score. Knowing your current credit score before you apply for a loan empowers you to address any issues and understand precisely where you stand with lenders. Credit Force within the HPCU mobile app or online banking offers a convenient way to stay on top of your credit, providing an updated score every 24 hours along with personalized credit score solutions designed to help you reach a tier that qualifies you for the lowest possible rates.

Research & Selection

With a clear understanding of your budget, a defined list of essential vehicle needs, and a strong grasp of your credit score, you've laid the groundwork for a smart car purchase. Now, it's time to confidently navigate the vast automotive landscape.

Online Research: Begin by researching various makes and models, comparing specifications, and even "building" your ideal vehicle online to get a realistic idea of potential pricing and features. For unbiased reviews, reliability ratings, and crucial safety information, consult reputable sources like Edmunds and Kelley Blue Book (KBB), paying close attention to long-term owner reviews. Now you can check the websites of local dealerships to see what vehicles they have in stock and pricing on select models you are interested in. If you are considering purchasing a used auto, use a VIN decoder to check the vehicle's history for accidents, title issues, and mileage discrepancies.

Shortlist Your Options: Based on your research, narrow down your choices to a few makes and models that meet your needs and budget. Compare features, fuel economy, safety ratings, and estimated long-term ownership costs. This comprehensive comparison will help you dial down to the best option that perfectly fits your lifestyle and financial plan.

Financing Your Purchase

You've put in the work reviewing your budget and needs, digging into your credit score to see where you stand, and even started exploring various vehicle options. Now let's talk about financing your purchase.

Pre-Approvals: Getting pre-approved for an auto loan means a lender has already evaluated your financial standing and has committed to lending you a specific amount before you even start car shopping. While this usually involves a "hard inquiry" that might temporarily ding your credit score, the advantages are well worth it. A pre-approval tells you exactly how much you can afford, empowering you to shop with confidence like a cash buyer and giving you stronger negotiating power at the dealership. You'll have a clear baseline to compare against dealership financing offers, ensuring you snag the best rate, and it streamlines the entire buying process.

Tax Benefits: For new vehicles purchased on or after January 1, 2025, you could benefit from a new federal tax deduction on auto loan interest. Always consult with a CPA or tax professional for personalized advice. For detailed information on the new federal tax deduction, please visit irs.gov.

Buying a car is a significant investment, but by following this guide, you can navigate the process with greater confidence and make informed decisions that align with your needs and budget.